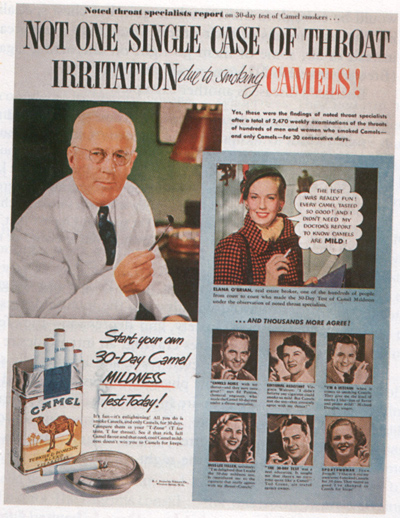

One of the most memorable images from the textbook for Sociology 201 class I took in college was this advertisement for Camel cigarettes from the 1950s (click the picture for the full-size version):

While the whole "doctor recommended" thing is pretty bad, the most insidious part of the ad is the extolling of the "30-day test." This probably seemed rather innocuous back then, but based on what we know now, one can only guess how many people's lives were cut short by lifelong addictions that began with this "test."

Thankfully, cigarette use is now on a sharp decline, as a result of changing norms and new laws. But that doesn't mean that the tricks used by cigarette makers to hook new users aren't being used anymore. One current ad campaign for sleeping pills that's running on TV is eerily similar to the old Camel cigarette ad:

The voiceover during the ad explicitly states that using sleeping pills can be addictive, but I guess they're hoping that the whole "free trial" thing will make people not appreciate what they're getting themselves into. While sleeping pills don't appear to be as unhealthy as cancer sticks, and the current generation of sleeping pills aren't as addictive as they once were, they do still carry many risks, and there are better ways to treat sleeping problems. Here's one article that explains some of the basics about what the sleeping pill manufacturers are currently engaged in, as well as a bit at the end about some more healthful alternatives:

Feeding the Sleeping Pill Addiction by Alan Cassels

Everything considered, I wonder if in 50 years the sleeping pill advertisement will be as galling to people as the cigarette advertisement is to us today.

Just as we haven't appeared to have learned our lesson from the addictiveness of cigarettes, so to have we apparently not learned our lesson from the Enron meltdown.

While Enron might be gone, the tactics they used are still alive and well. Here's a clip from The Daily Show from 2004 after the "Grandma Millie" tapes were released, which featured Enron traders detailing exactly what they were doing in California:

Of course, you can't always count on wildfires to limit the energy supply, and those at Enron had no problem creating artificial scarcity. A LA Times article from June 13, 2001 describes in detail what Enron and other energy companies did to increase profits:

Energy Execs Gain Millions in Stock Sales by Jerry Hirsch

Last month, Lynch told The Times that state investigators have uncovered evidence that a "cartel" of power companies shut down plants for unnecessary maintenance to create shortages and thus increase prices and profits. Lynch did not name the companies.

State and federal agencies are investigating the actions of several of the big energy companies, seeking to verify charges that they have conspired to boost prices by limiting construction of power plants, in one case, or by limiting the amount of natural gas available in the power-hungry California market.

I wonder what companies they identified doing this in 2001. Assuming Enron was one, what were the other ones? It appears that while Enron got busted for so egregiously breaking laws, the basic practice is creating artificial scarcity in the energy sector is nothing new. There's a fascinating and depressing article from June 21, 2004 on the website of The New Republic about how oil companies have engaged in this exact practice for at least the past 12 years. But they've maanged to get away with it year after year. Here's the link to this must read article:

Gas Mask by Clay Risen

Unfortunately, even though all the evidence about what's been going on has been available for sometime, very little, if anything, has been done in response.

On Wednesday, May 23, 2007, Congress passed a bill to combat gasoline price gouging. But the bill appears to be rather toothless and doesn't really do anything. Here's one article about the bill's passage:

House OKs Gas Price Gouging Penalties by H. Josef Hebert

But it gets better: The very next day, there was an article in the New York Times about how the oil companies are now using the U.S.'s meager forays into biofuels as yet another excuse to not increase capacity. Link to the article:

Oil Industry Says Biofuel Push May Hurt at Pump

by Jad Mouawad

Sigh. I'm hopeful, but not optimistic, that one day we'll be able to learn from the past so that we stop making the same mistakes over again. And hopefully that day comes before we find ourselves coping with $10 a gallon for gasoline by knocking ourselves out with horse tranquilizers.

No comments:

Post a Comment